Working from home has become part of the daily lives of many employees. In order to work properly at home, some employees first had to equip themselves with the appropriate equipment. Additionally, there are higher costs for heating, electricity and water. In order for these additional expenses to be deducted from your taxes, the federal government has now decided on the expected flat rate for the home office. Below we have summarized for you which costs you can deduct and for whom the flat rate is suitable.

What does the home office flat rate include?

To offset the additional burden of working from home, employees should do so in tax years In 2020, 2021 and 2022 five euros a day in the home office as advertising costs can be deducted from taxes. The annual maximum is 600 euros. This corresponds to 120 days covered by the flat rate. The days following this deadline cannot be claimed in the tax return. The amount of 600 euros is deducted from the taxable income when calculating taxes, thus reducing the tax burden to a minimum.

When can I benefit from the home office flat rate?

The flat rate of 5 euros for working from home will be included advertising costs counted. Advertising expenses are the costs that employees incur in order to do their jobs. These include, for example, costs for special work clothing, work furniture or commuter allowance. All taxpayersn A flat rate of 1,000 euros of advertising costs per year will be credited, regardless of whether these are reached or not.

➡️ You will only benefit if your advertising costs, including the flat rate for the home office, exceed 1,000 euros.

The decisive factor for the amount of advertising costs is, among other things, the duration of the daily commute and the associated costs Flat rate commuter fare. This flat rate is for Commuters from the 21st kilometer with retroactive effect from 1 January 2022 to 0.38 Euros per kilometre relieved. The indicated lump sum can be deducted from the taxable income per working day.

What additional costs can be deducted from your taxes when working from home?

Until now, a home office could only be claimed for tax purposes if the room was used exclusively for work and if the home office met the requirements for the deduction.

With the new decision from the federal government, employees can now also claim their workplace in the kitchen, living room or another room for tax purposes using the flat rate.

Purchases such as: B. a desk, printer, office chair, or laptop if these are not provided by the employer. A telephone and Internet connection used for work may also be indicated in the tax return, which is usually calculated at around 20% of the monthly bill.

Do home office days need to be proven?

Normally the tax office does not require any proof for advertising costs of less than 1,000 euros. However, we recommend that you keep your invoices and cost receipts in case the tax office has questions about individual amounts. This is also recommended for the home office flat rate. A confirmation from the employing company on the number of days of working from home is sufficient.

For the years 2020 and 2021, however, a reduction in the burden of proof is planned, as it was only introduced retroactively in 2020 and in 2021 many details were still unclear. In 2022 the burden of proof will no longer apply, which is why it is even more important that there is accurate documentation of working days in the home office.

Our software integrates proof of working hours into your home office

In our PROCESS HR software you can have a corresponding report issued which lists the total number of working days spent in the office and at the same time generates a corresponding receipt with a signature field for the employer. This gives you a clear list and saves you the hassle of recounting your home office days.

latest posts published

Are you starting to run? This is how we persevere!

Your time invested profitably every day: What are your EPAs?

Energy flat rate: who is entitled to the 300 euro bonus?

Here’s how companies choose the right solution

Set and achieve goals with SMART

Different working models and employee retention: a connection?

Flexible working hours

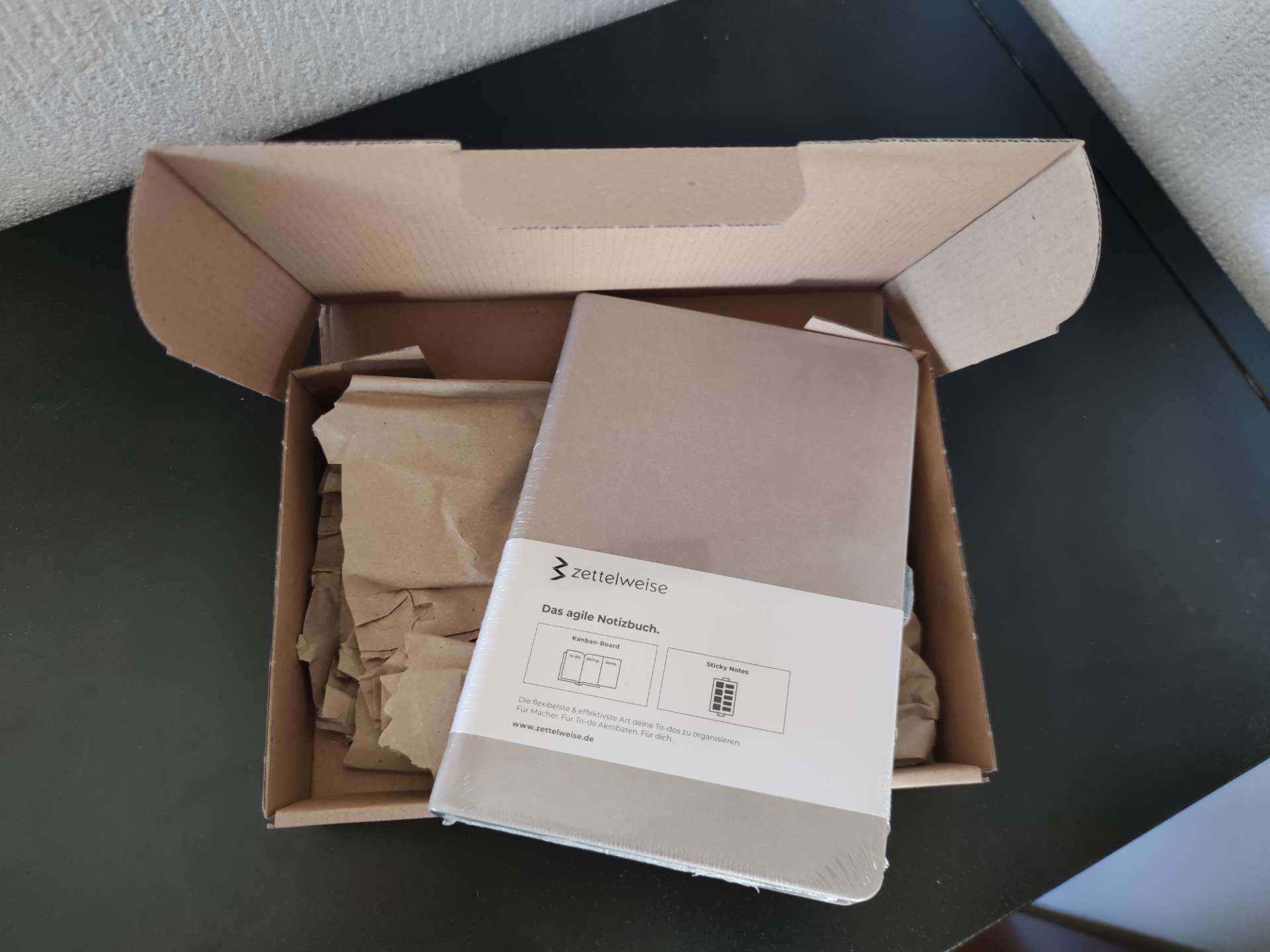

Personal Kanban in the notebook: be productive

Reporting for effective workforce management